Euro, pound surge as U.S. rate cut odds grow after Powell hint

Anabelle Colaco

29 Jun 2025, 05:06 GMT+10

- The U.S. dollar tumbled this week, hitting its lowest levels since 2021 against the euro, British pound, and Swiss franc, as markets ramped up bets that the Federal Reserve will cut interest rates sooner—and more aggressively—than previously expected

- The decline followed Fed Chair Jerome Powell’s comments to Congress this week, which investors interpreted as dovish

- Powell repeated that inflation could rise this summer but noted that “we will get to a place where we cut rates sooner than later” if price pressures remain contained

NEW YORK CITY, New York: The U.S. dollar tumbled this week, hitting its lowest levels since 2021 against the euro, British pound, and Swiss franc, as markets ramped up bets that the Federal Reserve will cut interest rates sooner—and more aggressively—than previously expected.

The decline followed Fed Chair Jerome Powell's comments to Congress this week, which investors interpreted as dovish. Powell repeated that inflation could rise this summer but noted that "we will get to a place where we cut rates sooner than later" if price pressures remain contained.

That tone opened the door to a potential rate cut as early as July, according to traders and analysts.

"This week it's definitely been about the Fed," said Eric Theoret, FX strategist at Scotiabank. "The prospect of easing sooner and potentially more rate cuts" is driving the current selloff in the dollar, he said.

Noel Dixon of State Street Global Markets added: "Powell kind of opened the door to potentially a July cut. If the next CPI release is below market expectations, I think markets will start to price in the probability of a cut to July."

As of Friday, Fed funds futures showed a 23 percent probability of a July rate cut, up from 13 percent just a week ago. The likelihood of a cut by September now stands at 93 percent. Traders are currently pricing in 66 basis points of easing by year-end—indicating a potential third 25-basis point move, up from 46 basis points last Friday.

Adding to the pressure on the dollar, President Donald Trump said he plans to nominate a new Fed Chair once Powell's term ends in May 2026. Trump, who has long criticised Powell, said this week that he has "three or four" potential replacements in mind and could name one by September or October. The Wall Street Journal reported that the choice could act as a "shadow Fed Chair," potentially undermining Powell's influence.

"That could be a problem if inflation reaccelerates," said Dixon. "The message there would be that they would discount the inflation."

However, Chicago Fed President Austan Goolsbee pushed back on that idea, stating that any replacement named before confirmation "would have no influence on monetary policy."

This week In forex markets, the euro rose 0.51 percent to US$1.1719, reaching as high as $1.1744—its strongest level since September 2021. The British pound climbed 0.62 percent to $1.3748, touching $1.3770, the highest since October 2021. The Swiss franc surged to 0.799 per dollar, a 10.5-year high. The dollar slipped 0.72 percent to 144.2 yen.

Beyond the Fed, investors are watching two other key U.S. deadlines: a July 9 target for avoiding new trade tariffs, and a July 4 Senate goal for passing a tax and spending bill. That legislation, if passed, could boost growth and potentially support the dollar.

But for now, structural concerns remain. "The budget and current account deficits are negative for the dollar," Dixon said.

Longer term, a reallocation of international capital away from U.S. assets could also weigh on the currency. "You've got a lot of asset managers that are long the U.S. dollar way more than I think they're comfortable," said Theoret.

In crypto markets, bitcoin dipped 0.43 percent to $107,382.

Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of Austin Globe news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to Austin Globe.

More InformationBusiness

SectionCanadian tax on US tech giants dropped after Trump fury

WASHINGTON, D.C.: On Friday, President Donald Trump announced that he was halting trade discussions with Canada due to its decision...

Trump-backed crypto project gets $100 million boost from UAE fund

LONDON, U.K.: A little-known investment fund based in the United Arab Emirates has emerged as the most prominent public backer of U.S....

DIY weight-loss drug trend surges amid high prices, low access

SAN FRANCISCO, California: Across the U.S., a growing number of people are taking obesity treatment into their own hands — literally....

Apple allows outside payment links under EU pressure

SAN FRANCISCO, California: Under pressure from European regulators, Apple has revamped its App Store policies in the EU, introducing...

Euro, pound surge as U.S. rate cut odds grow after Powell hint

NEW YORK CITY, New York: The U.S. dollar tumbled this week, hitting its lowest levels since 2021 against the euro, British pound, and...

Sam’s Club fulfillment center to shut in Texas, jobs impacted

NEW YORK CITY, New York: Walmart is set to close a major Sam's Club fulfillment center in Fort Worth, Texas, as part of a shift in...

Texas

SectionMexican President orders review of SpaceX environmental impact

MEXICO CITY, Mexico: Mexican President Claudia Sheinbaum said this week that her government is investigating possible environmental...

Sam’s Club fulfillment center to shut in Texas, jobs impacted

NEW YORK CITY, New York: Walmart is set to close a major Sam's Club fulfillment center in Fort Worth, Texas, as part of a shift in...

Job board pioneers CareerBuilder, Monster face bankruptcy

NEW YORK, U.S.: Two giants of the early internet job search era—CareerBuilder and Monster—have formally filed for bankruptcy protection,...

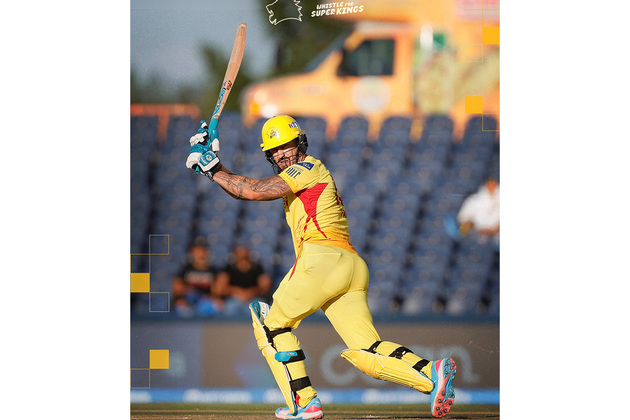

Du Plessis, Ferreira power Texas Super Kings into knockouts with dominant win over MI New York

Dallas [US], June 30 (ANI): The South African stars of Texas Super Kings (TSK) rose to the occasion as they secured a commanding 39-run...

Here is how Lauren Sanchez's kids played important role in her, Jeff Bezos' wedding

Washington DC [US], June 30 (ANI): Former news anchor Lauren Sanchez officially tied the knot with Jeff Bezos in a star-studded Italian...

Emma Stone praises Austin Butler's quick thinking during viral bee encounter at Cannes

Washington [US], June 29 (ANI): Emma Stone has come to the defence of her 'Eddington' co-star Austin Butler after a viral incident...