Unlock Business Stability with Key Person Insurance

7Newswire

08 Sep 2023, 18:54 GMT+10

Certainly, as a business owner, you aim for nothing short of success and stability. An unfortunate reality is businesses often encounter unexpected hurdles which can destabilize even the strongest enterprises.

One such potential obstacle could be the sudden incapacity or loss of a crucial individual, whom the business heavily relies upon: the "key person". Strategies come into play to mitigate such challenges and one highly beneficial strategy is investing in key-person insurance.

Defining Key Person Insurance

Key person insurance, explained in the most basic terms, is a life insurance policy taken out by a business on a vital individual within that company. Irreplaceable talent or specific individuals who contribute significantly to your business's profitability are typically considered key individuals.

Their loss could potentially cause substantial financial harm to the business. Therefore, insuring the key people at your company leads to risk mitigation by providing financial aid to absorb any potential business disruptions if something unfortunate were to happen.

The Value to Businesses

A huge benefit of key person insurance is its ability to protect your business from uncertainty and enhance its overall financial security. Say you have an employee who has exclusive knowledge of unique industry standards or maintains healthy relationships with ample clients; their sudden departure could leave your firm in considerable turmoil.

With key person insurance, firms are safeguarded because the company would receive a death benefit to offset revenue losses and cover costs associated with finding replacement talent.

Choosing the Right Policy

Ascertaining your firm's risk levels is imperative when selecting an ideal key person insurance policy. It's recommended that you analyze how much it would cost your business if it were to lose certain valuable employees unexpectedly.

This includes calculating lost revenues and adding operational expenses that would accrue during transitional periods after such incidents. Appropriate coverage amounts should then be established based on this evaluation.

Strategic Uses of Key Person Insurance

In addition to financing death benefits and replacement costs connected with losing a critical staff member, resources from key person insurance can also fund transition periods instantly following such an occurrence. Instead of using valuable business savings or securing loans during these critical periods, financial assistance can be derived directly from these policies.

Tax Implications and Advantages

Keyperson insurance policies offer tax benefits as well as additional advantages regarding premium payments and monetary rewards from death benefits. However, these largely depend on the local jurisdiction governing your business operations.

It would serve you best to consult with a tax advisor to inform yourself properly about these laws as they pertain to premiums paid towards key person policy and taxation rules surrounding death benefits received under this sort of scheme.

Dispelling Common Misconceptions

Many misconceptions about key person insurance may deter you whilst considering it for your organization - for example, unnecessary viewing it as a bonus or perk offered purely for upper management.

Some also believe that small businesses do not require this type of protection which is also not true. Business size does not determine requirements here but rather what individual loss might imply financially for that setup.

Incorporating Key Person Insurance into Succession Planning

Key person insurance is excellent when you align it with the succession strategies at your firm to enhance long-term goals. All forms of life insurance offer peace of mind knowing things will be looked after financially upon one's passing but integrating policies within broader plans ensures there is continuity.

The business continuity solutions market is growing, and keyperson insurance is an essential aspect of succession and transition.

Determining Your Business's Needs

Whether running a small boutique firm or managing a large multinational corporation, each requires careful deliberation regarding their unique needs for key person insurance.

Every enterprise has its own particular challenges and benefits so what works well for one may not work best in another case. Unique factors that determine this include industries operating within geographical locations, capital structures risk attitudes, talent pool demographics, etc.

Exploring Policy Providers

Investing in key person insurance becomes more productive when you properly research and compare policy providers. Look beyond the presented prices and delve into the nuances of each potential agreement. Scrutinize the conditions regarding benefit payouts and terms of coverage. Each can vastly differ from one insurer to another.

Tailoring Policy Terms

Another significant factor to consider is customizing the policy according to your business requirements. Adapting coverage terms to suit your unique context allows you to get a truly suitable insurance policy that ensures optimal security for your key individuals.

There are many different types of employee benefits, including life insurance. But, keyman insurance is tailored differently as it is the company that will receive a death benefit, not the employee's family.

Wrapping Up

Planning for any eventuality is instrumental to a business's future. This is exactly the purpose of key person insurance. It assures your business can weather unexpected hurdles and remain resilient. Every strategy revolves around securing stability and minimizing uncertainties. Reflect on how such a policy could significantly assist your organization. Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of Austin Globe news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to Austin Globe.

More InformationBusiness

SectionWall Street extends rally, Standard and Poor's 500 hits new high

NEW YORK, New York - U.S. stock markets closed firmly in positive territory to start the week Monday, with the S&P 500 and Dow Jones...

Canadian tax on US tech giants dropped after Trump fury

WASHINGTON, D.C.: On Friday, President Donald Trump announced that he was halting trade discussions with Canada due to its decision...

Trump-backed crypto project gets $100 million boost from UAE fund

LONDON, U.K.: A little-known investment fund based in the United Arab Emirates has emerged as the most prominent public backer of U.S....

DIY weight-loss drug trend surges amid high prices, low access

SAN FRANCISCO, California: Across the U.S., a growing number of people are taking obesity treatment into their own hands — literally....

Apple allows outside payment links under EU pressure

SAN FRANCISCO, California: Under pressure from European regulators, Apple has revamped its App Store policies in the EU, introducing...

Euro, pound surge as U.S. rate cut odds grow after Powell hint

NEW YORK CITY, New York: The U.S. dollar tumbled this week, hitting its lowest levels since 2021 against the euro, British pound, and...

Texas

SectionMexican President orders review of SpaceX environmental impact

MEXICO CITY, Mexico: Mexican President Claudia Sheinbaum said this week that her government is investigating possible environmental...

Sam’s Club fulfillment center to shut in Texas, jobs impacted

NEW YORK CITY, New York: Walmart is set to close a major Sam's Club fulfillment center in Fort Worth, Texas, as part of a shift in...

Job board pioneers CareerBuilder, Monster face bankruptcy

NEW YORK, U.S.: Two giants of the early internet job search era—CareerBuilder and Monster—have formally filed for bankruptcy protection,...

"This is a film from India, for the world": Anupam Kher shares heartwarming response to 'Tanvi The Great' trailer, global premieres

Mumbai (Maharashtra) [India], June 30 (ANI): Anupam Kher's upcoming directorial 'Tanvi The Great' is creating a buzz in the entertainment...

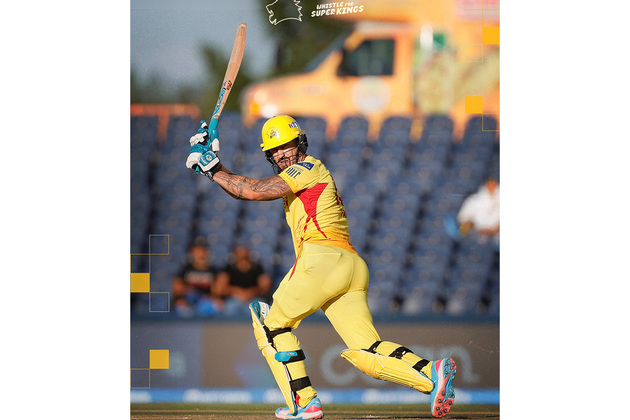

Du Plessis, Ferreira power Texas Super Kings into knockouts with dominant win over MI New York

Dallas [US], June 30 (ANI): The South African stars of Texas Super Kings (TSK) rose to the occasion as they secured a commanding 39-run...

Here is how Lauren Sanchez's kids played important role in her, Jeff Bezos' wedding

Washington DC [US], June 30 (ANI): Former news anchor Lauren Sanchez officially tied the knot with Jeff Bezos in a star-studded Italian...