Deciphering GASB Statement 96: A Comprehensive Overview

Evertise

24 May 2023, 15:54 GMT+10

The Governmental Accounting Standards Board (GASB) is a regulatory body that establishes accounting and financial reporting standards for state and local governments. In December 2020, it issued GASB Statement 96, a landmark directive concerning subscription-based information technology arrangements (SBITAs).

SBITAs typically involve a government entity subscribing to an information technology software, platform, or infrastructure from a third-party provider. These subscriptions often include software updates, data storage, and technical support.

Before GASB Statement 96, there was no specific accounting guidance for these arrangements, which led to inconsistent accounting and reporting practices. GASB Statement 96 sets out the standard for these arrangements, leading to more consistency and transparency in governmental financial reporting.

Impact on Businesses

Classification and Capitalization of SBITAs

GASB Statement 96 impacts how businesses record their SBITAs. It classifies these as capitalizable right-to-use (RTU) leases, with certain exceptions. This means that if a business subscribes to an IT service, it can recognize the RTU as an intangible asset, with the corresponding liability recorded as well.

This change will impact businesses' balance sheets, as they may see an increase in both their assets and liabilities. Moreover, businesses will need to evaluate their existing and future SBITAs to determine if they fall under the GASB Statement 96 guidelines.

Contract Cost Considerations

GASB Statement 96 also provides guidance on contract cost considerations. It specifies that outlays (other than those for subscriptions) associated with the implementation of an SBITA should be capitalized based on existing GASB standards.

For businesses, this clarification provides more consistent guidance on what costs can be capitalized and reduces ambiguity in determining which costs should be expensed and which should be capitalized.

Why GASB Statement 96 Is Important

Promoting Consistency and Comparability

One of the main reasons GASB Statement 96 is important is that it promotes consistency and comparability in financial reporting. By providing clear guidelines on how to account for SBITAs, it ensures that different entities follow the same accounting practices. This uniformity allows for a fair comparison between entities and enhances the reliability of financial information.

Enhancing Financial Transparency

GASB Statement 96 also enhances financial transparency. Previously, because there was no specific guidance on SBITAs, these arrangements were recorded differently by different entities, making it difficult for users of financial statements to understand the entity's obligations.

With the introduction of GASB Statement 96, entities must recognize an intangible asset and a corresponding liability for SBITAs, making their obligations clearer to stakeholders. This increased transparency can boost stakeholders' confidence in the entity's financial reporting.

Adapting to Technological Advancements

GASB Statement 96 is a significant step towards adapting accounting standards to the rapidly evolving technological environment. With more entities turning to subscription-based IT services, it's important for accounting standards to keep pace with these changes and provide relevant guidance.

Compliance with GASB Statement 96

Adherence to GASB Statement no. 96 isn't optional-it's a requirement for government entities and businesses engaged in SBITAs. Compliance demands a comprehensive review of existing SBITAs to identify which arrangements fall under the purview of GASB 96. This might mean revisiting contracts, consulting with legal experts, and recalibrating the accounting process to align with the new requirements.

This directive also necessitates training for accountants and financial staff to ensure they're well-versed with the nuances of the statement and its implications. Non-compliance isn't just a breach of regulation-it can also lead to financial misstatements, affecting the credibility and reliability of the entity's financial reports.

Implementation Challenges and Solutions

While GASB Statement 96 undoubtedly enhances financial reporting, its implementation is not without challenges. The process can be time-consuming and complicated, requiring the navigation of complex contract details and sophisticated accounting procedures. Entities might need to invest in advanced accounting software and systems to effectively record and track SBITAs according to the new standards.

A proactive approach can help ease the transition. Engaging in early planning and seeking professional advice can mitigate potential difficulties. Moreover, businesses might consider turning to IT solutions for automation and accuracy in dealing with the intricacies of SBITAs under GASB Statement 96.

Looking Ahead: GASB Statement 96 and Beyond

The advent of GASB Statement 96 marks an important milestone in governmental accounting, but it's just one part of the continually evolving landscape. As technology continues to disrupt traditional business models and practices, accounting standards must keep pace. Staying updated with these changes isn't merely a compliance exercise-it's a strategic imperative that can influence an entity's financial standing and reputation.

The forward-looking business will view GASB Statement 96 not as a burden but as an opportunity-a chance to streamline processes, improve financial transparency, and ultimately, build trust with stakeholders. And that, at its core, is the essence of sound financial reporting.

GASB Statement 96 is a significant development in governmental accounting standards. It provides clear guidance on the accounting and reporting of SBITAs, promoting consistency, enhancing transparency, and adapting to technological advancements. It impacts how businesses record their IT subscriptions and the costs associated with these contracts. Businesses need to understand this statement to comply with its requirements and accurately present their financial position.

Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of Austin Globe news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to Austin Globe.

More InformationBusiness

SectionCanadian tax on US tech giants dropped after Trump fury

WASHINGTON, D.C.: On Friday, President Donald Trump announced that he was halting trade discussions with Canada due to its decision...

Trump-backed crypto project gets $100 million boost from UAE fund

LONDON, U.K.: A little-known investment fund based in the United Arab Emirates has emerged as the most prominent public backer of U.S....

DIY weight-loss drug trend surges amid high prices, low access

SAN FRANCISCO, California: Across the U.S., a growing number of people are taking obesity treatment into their own hands — literally....

Apple allows outside payment links under EU pressure

SAN FRANCISCO, California: Under pressure from European regulators, Apple has revamped its App Store policies in the EU, introducing...

Euro, pound surge as U.S. rate cut odds grow after Powell hint

NEW YORK CITY, New York: The U.S. dollar tumbled this week, hitting its lowest levels since 2021 against the euro, British pound, and...

Sam’s Club fulfillment center to shut in Texas, jobs impacted

NEW YORK CITY, New York: Walmart is set to close a major Sam's Club fulfillment center in Fort Worth, Texas, as part of a shift in...

Texas

SectionMexican President orders review of SpaceX environmental impact

MEXICO CITY, Mexico: Mexican President Claudia Sheinbaum said this week that her government is investigating possible environmental...

Sam’s Club fulfillment center to shut in Texas, jobs impacted

NEW YORK CITY, New York: Walmart is set to close a major Sam's Club fulfillment center in Fort Worth, Texas, as part of a shift in...

Job board pioneers CareerBuilder, Monster face bankruptcy

NEW YORK, U.S.: Two giants of the early internet job search era—CareerBuilder and Monster—have formally filed for bankruptcy protection,...

"This is a film from India, for the world": Anupam Kher shares heartwarming response to 'Tanvi The Great' trailer, global premieres

Mumbai (Maharashtra) [India], June 30 (ANI): Anupam Kher's upcoming directorial 'Tanvi The Great' is creating a buzz in the entertainment...

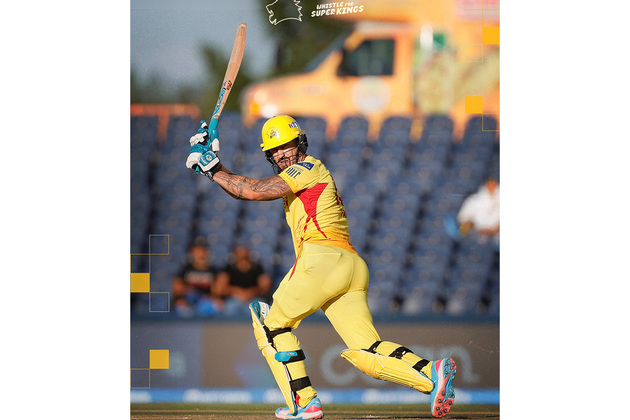

Du Plessis, Ferreira power Texas Super Kings into knockouts with dominant win over MI New York

Dallas [US], June 30 (ANI): The South African stars of Texas Super Kings (TSK) rose to the occasion as they secured a commanding 39-run...

Here is how Lauren Sanchez's kids played important role in her, Jeff Bezos' wedding

Washington DC [US], June 30 (ANI): Former news anchor Lauren Sanchez officially tied the knot with Jeff Bezos in a star-studded Italian...