GWG Holdings Leaves Many Questions For Investors

7Newswire

21 Sep 2022, 22:21 GMT+10

GWG Holdings Inc. (NASDAQ: GWGH), also known as GWG, filed for Chapter 11 bankruptcy protection in the U.S. Bankruptcy Court for the Southern District of Texas on March 15, 2019. (case number 22-90032). The firm's total liabilities were estimated to be at $2.1 billion.

The recent declines in the value of various stock, preferred stock, and bond investments issued, as well as the pending bankruptcy, could be disastrous for GWG investors who purchased and are likely still holding various bonds, preferred stock, or common stock in GWG, as it could mean they have or will face investment losses based on the decline in the value of those securities.

Many investors that were sold GWG L Bonds are now filing claims against their financial advisors. The law firm Haselkorn & Thibaut is representing investors to recover what may be huge losses. Investors can call 1 888-628-5590 for a free consultation.

GWG Holdings is currently dealing with a series of accounting issues. The company has been struggling to file financial statements, and in October 2020, the SEC's enforcement division served the company with a subpoena. These issues are related to GWG's bond issuance and accounting practices.

While this may not seem like a big deal to many people, the questions raised by the SEC could negatively impact the company's bond sales. This has caused broker firms to suspend sales of the company's bonds until further notice.

Among other things, GWG has been late filing its annual financials. The company had also disclosed that it had entered into a series of transactions with an unregistered investment company named Beneficient. These deals resulted in a reorientation of the business and a diversification of its exposure to alternative assets. While it is unclear whether these issues have affected the company's finances, GWG has taken steps to rectify the situation.

The company is now exploring rescue financing options. Since it cannot sell its products, GWG is exploring options to limit its debt and refinance its senior credit facilities. It is also looking into the possibility of Chapter 11 bankruptcy.

The lack of liquidity at GWG Holdings Inc. was a major concern for investors. An SEC investigation was launched in 2020, and the company had failed to file its annual report properly and was failing to issue bonds.

As a result, the firm could not meet its financial obligations, which hurt its liquidity. Additionally, it is now facing legal action from its investors, who claim that the company mishandled its funds and failed to disclose the SEC investigation.

The company filed with the Securities and Exchange Commission on January 18, explaining that it lacks liquidity and capital in the market. This is a very concerning development for investors, especially retail investors who invested in GWG's L Bonds. Without liquidity, GWG Holdings will face a significant reduction in value.

To make matters worse, GWG has been battling insolvency and recently added two new independent directors to its board. These new directors will serve until the bankruptcy court approves its reorganization plan or dismisses the Chapter 11 cases. They will also determine the company's long-term financial and operational outlook.

Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of Austin Globe news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to Austin Globe.

More InformationBusiness

SectionWall Street extends rally, Standard and Poor's 500 hits new high

NEW YORK, New York - U.S. stock markets closed firmly in positive territory to start the week Monday, with the S&P 500 and Dow Jones...

Canadian tax on US tech giants dropped after Trump fury

WASHINGTON, D.C.: On Friday, President Donald Trump announced that he was halting trade discussions with Canada due to its decision...

Trump-backed crypto project gets $100 million boost from UAE fund

LONDON, U.K.: A little-known investment fund based in the United Arab Emirates has emerged as the most prominent public backer of U.S....

DIY weight-loss drug trend surges amid high prices, low access

SAN FRANCISCO, California: Across the U.S., a growing number of people are taking obesity treatment into their own hands — literally....

Apple allows outside payment links under EU pressure

SAN FRANCISCO, California: Under pressure from European regulators, Apple has revamped its App Store policies in the EU, introducing...

Euro, pound surge as U.S. rate cut odds grow after Powell hint

NEW YORK CITY, New York: The U.S. dollar tumbled this week, hitting its lowest levels since 2021 against the euro, British pound, and...

Texas

SectionMexican President orders review of SpaceX environmental impact

MEXICO CITY, Mexico: Mexican President Claudia Sheinbaum said this week that her government is investigating possible environmental...

Sam’s Club fulfillment center to shut in Texas, jobs impacted

NEW YORK CITY, New York: Walmart is set to close a major Sam's Club fulfillment center in Fort Worth, Texas, as part of a shift in...

Job board pioneers CareerBuilder, Monster face bankruptcy

NEW YORK, U.S.: Two giants of the early internet job search era—CareerBuilder and Monster—have formally filed for bankruptcy protection,...

"This is a film from India, for the world": Anupam Kher shares heartwarming response to 'Tanvi The Great' trailer, global premieres

Mumbai (Maharashtra) [India], June 30 (ANI): Anupam Kher's upcoming directorial 'Tanvi The Great' is creating a buzz in the entertainment...

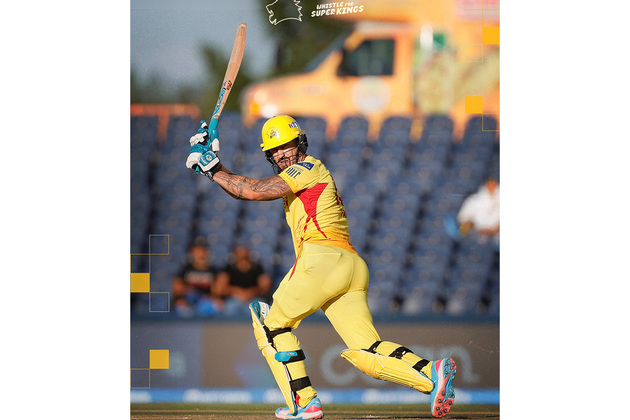

Du Plessis, Ferreira power Texas Super Kings into knockouts with dominant win over MI New York

Dallas [US], June 30 (ANI): The South African stars of Texas Super Kings (TSK) rose to the occasion as they secured a commanding 39-run...

Here is how Lauren Sanchez's kids played important role in her, Jeff Bezos' wedding

Washington DC [US], June 30 (ANI): Former news anchor Lauren Sanchez officially tied the knot with Jeff Bezos in a star-studded Italian...