What is Payroll Compliance in Indonesia?

Evertise

16 May 2023, 18:54 GMT+10

Are you planning to expand your business in Indonesia or currently managing a company there? Then, it's essential to understand the payroll compliance requirements of this country. Payroll in Indonesia is subject to strict regulations and compliances by government authorities such as the Board of the Republic of Indonesia (BKPM), Auditing, Labour & HR work. This blog post will provide you with an overview of these payroll compliance requirements and how they affect businesses operating in Indonesia. So, let's dive into the world of Indonesian payroll regulations!

What are the payroll deductions in Indonesia?

Indonesia follows a progressive tax system, in other words, the more you earn, the higher percentage of your salary is taxed. The payroll deductions in Indonesia comprise several components, including taxes and social security contributions.

One of the significant payroll deductions in Indonesia is the income tax. As per Indonesian law, employers must withhold employees' income tax from their salaries every month and pay it to the government on behalf of their employees. The income tax an employee pays depends on their gross monthly salary.

Apart from income tax, both employers and employees need to contribute towards social security schemes such as BPJS Kesehatan (healthcare), BPJS Ketenagakerjaan (workers' compensation), The contribution rates for these programs vary based on certain factors like age, employment status, and other criteria set by the government.

It's important for businesses operating in Indonesia to ensure that they comply with all payroll deduction requirements. Failure to do so may result in penalties or legal action against them. With proper knowledge about payroll compliance regulations in Indonesia, companies can avoid any potential issues related to non-compliance while ensuring smooth operations for themselves

and their employees.

Types of payroll compliance

When it comes to payroll in Indonesia, businesses must adhere to several types of regulations. The first type is tax compliance, which involves ensuring that the correct amount of taxes is being withheld and paid on behalf of employees.

Another critical aspect of payroll compliance is labor law compliance. This includes adhering to minimum wage requirements, ensuring proper employee benefits such as health insurance and retirement plans, and following all other labor laws.

A third type of payroll compliance is social security contribution. In Indonesia, employers and employees must contribute to social security programs such as pensions and healthcare. Businesses must ensure they accurately calculate these contributions and submit them on time.

Auditing compliance is also a crucial part of proper payroll management in Indonesia.

Companies need to maintain accurate payroll records while keeping track of any changes made along the way. These records can be used during audits by government agencies or internal auditors when assessing a company's financial practices.

Adherence to these various types of payroll compliances ensures that businesses operating in Indonesia remain compliant with local laws while offering fair compensation packages for their employees.

How do Indonesia's payroll laws affect businesses?

Indonesia's payroll laws have significant impacts on businesses operating in the country. One of the key aspects is compliance with tax obligations and social security contributions, which can be complex due to frequent changes in regulations.

Businesses must also adhere to minimum wage requirements and ensure that they are paying their employees fairly. Failure to comply with these regulations could result in penalties or legal actions against the company.

Moreover, companies must keep accurate records of their payroll transactions and provide regular reports as required by law. This involves maintaining detailed documentation such as employee contracts, payslips, tax returns, and other financial statements.

To stay compliant with Indonesia's payroll laws, businesses may consider outsourcing their payroll processing needs to professional service providers specializing in regulatory compliance. This approach ensures that all necessary calculations are accurately performed while minimizing risks associated with non-compliance.

Businesses must understand how Indonesia's payroll laws affect them to maintain compliance while avoiding potential legal issues that could harm their operations or reputation within the local market.

Conclusion

Payroll compliance in Indonesia is a crucial aspect that businesses must understand and adhere to. The various deductions, such as taxes, social security contributions, and health insurance premiums, can be complex. Companies must have an experienced team or work with external experts well-versed in Indonesian payroll laws.

The government of Indonesia, through the Board of the Republic of Indonesia (BKPM), has put measures in place to enforce compliance with these regulations. Non-compliance could result in hefty fines or even legal action against a company.

Therefore, it's vital for businesses operating within Indonesia to stay up-to-date on any changes in payroll legislation and ensure that they are compliant at all times. By doing so, companies can avoid potential legal issues while fostering positive relationships with their employees by providing accurate and timely compensation packages.

Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of Austin Globe news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to Austin Globe.

More InformationBusiness

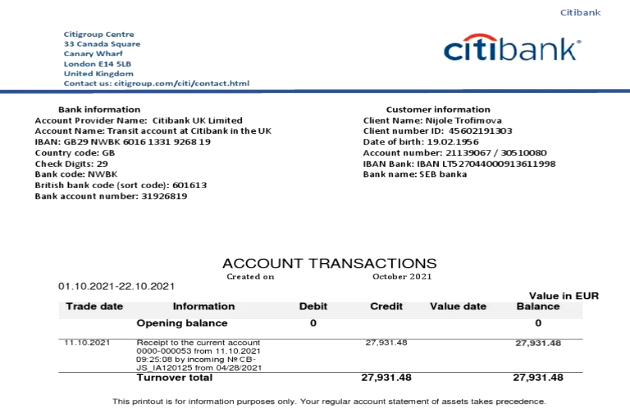

SectionCitigroup mistakenly credits $81 trillion to customer instead of $280

NEW YORK CITY, New York: A routine banking transaction at Citigroup last April turned into a major blunder when the bank mistakenly...

Looming tariffs on trade torpedo U.S. stock markets

NEW YORK, New York - U.S. and Canadian stocks sank Monday, weighed down by President Donald Trump's looming trade tariffs. The introduction...

Nasdaq Composite sinks 497 points as trade tariffs loom

NEW YORK, New York - U.S. and Canadian stocks tumbled on Monday, the first trading day of March, with investors spooked by looming...

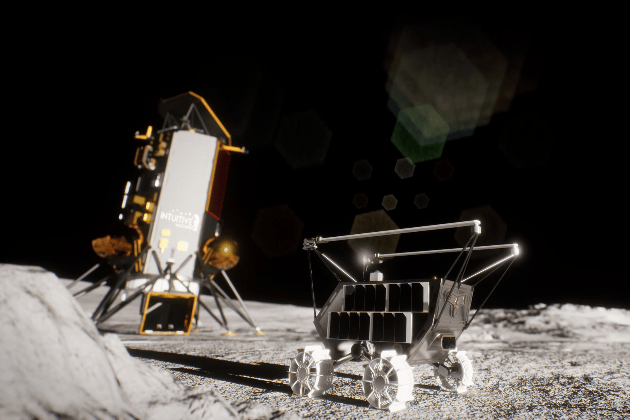

Intuitive Machines launches rocket for moon’s south pole mission

CAPE CANAVERAL, Florida: A new private lunar mission is on its way to the moon, as Intuitive Machines launched its second lander, Athena,...

Gatwick set for second runway as UK greenlights expansion

LONDON, U.K.: The UK government has tentatively approved the expansion of Gatwick Airport, paving the way for a second runway, drawing...

North Korean-backed hackers steal $1.5 billion from Dubai crypto firm

ROME, Italy: U.S. authorities have accused North Korean-backed hackers of stealing US$1.5 billion in cryptocurrency from Dubai-based...

Texas

SectionUS military given 30 days to plan transgender troop removals

WASHINGTON, D.C.: The U.S. military has 30 days to decide how it will find and remove transgender service members. This may involve...

Intuitive Machines launches rocket for moon’s south pole mission

CAPE CANAVERAL, Florida: A new private lunar mission is on its way to the moon, as Intuitive Machines launched its second lander, Athena,...

Monkey business has global health authorities hopping

Ramadewa looked at the numerous troops of monkeys. They were at ease and happy and showed their liveliness. All their movements, their...

Earthquake of magnitude 4.2 rocks Tibet

Tibet, March 4 (ANI): An earthquake of magnitude 4.2 on the Richter Scale jolted Tibet on Tuesday, as per a statement by the National...

Hawks, facing Bucks, aim to build on stunning comeback win

(Photo credit: Petre Thomas-Imagn Images) The Atlanta Hawks hope to build on a thrilling come-from-behind win when they return home...

Sharks pursue rare winning streak in visit to Buffalo

(Photo credit: John E. Sokolowski-Imagn Images) The San Jose Sharks and the Sabres each played beyond regulation on Monday ahead...