Another 50 US banks could fail ex-Lehman VP

RT.com

22 Mar 2023, 19:44 GMT+10

The former senior executive says the Fed must cut rates and guarantee deposits held by regional lenders

The banking crisis could swallow another 50 regional lenders in the US if the country's authorities don't take appropriate steps to resolve structural issues, former vice-president at Lehman Brothers Lawrence McDonald has said in an interview with RIA Novosti.

"Policy-makers will most likely be forced to introduce a much larger withholding to maintain outflows of deposits from bank accounts that significantly exceed $250,000," he said.

The collapse of Lehman Brothers, which caused funding markets to seize up and made it hard for global lenders to get a hold of US dollars, marked the beginning of the global financial crisis in 2008.

According to McDonald, the current problems challenging the US banking sector are very similar to those preceding the infamous collapse of the financial giant.

The former executive added that US regional banks are expected to lose "hundreds of billions of dollars" with these funds inevitably moving to larger lenders, and then to treasury bonds.

The US authorities will have to heavily boost deposit guarantees compared to the existing ones, McDonald said.

On Tuesday, several media outlets reported that officials at the US Department of Treasury were discussing increasing deposit insurance in case of a deterioration in the banking sector. The step will reportedly require funds from the Treasury Department's Exchange Stabilization Fund.

McDonald accused Federal Reserve Chairman Jerome Powell of following inadequate policies in tightening monetary policy.

"They seem to be smoking in a dynamite shed. Ten days ago, Powell on Capitol Hill told us that the banking system was OK... He either lied or did not understand what he was doing," the former banker suggested.

According to McDonald, the Fed will have to cut rates and then have a deposit guarantee, a larger one.

"That's what they're going to come up with... That's a bailout. That's basically the federal government taking on bank-deposit risk," he concluded.

For more stories on economy & finance visit RT's business section

(RT.com)

Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of Austin Globe news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to Austin Globe.

More InformationBusiness

SectionMeta hires SSI CEO Gross as AI race intensifies among tech giants

PALO ALTO/TEL AVIV: The battle for top AI talent has claimed another high-profile casualty—this time at Safe Superintelligence (SSI),...

Engine defect prompts Nissan to recall over 443,000 vehicles

FRANKLIN, Tennessee: Hundreds of thousands of Nissan and Infiniti vehicles are being recalled across the United States due to a potential...

Microsoft trims jobs to manage soaring AI infrastructure costs

REDMOND, Washington: Microsoft is the latest tech giant to announce significant job cuts, as the financial strain of building next-generation...

Stocks worldwide struggle to make ground Friday with Wall Street closed

LONDON UK - U.S. stock markets were closed on Friday for Independence Day. Global Forex Markets Wrap Up Friday with Greeback Comeback...

Nvidia briefly tops Apple’s record in AI-fueled stock rally

SANTA CLARA, California: Nvidia came within a whisker of making financial history on July 3, briefly surpassing Apple's all-time market...

ICE raids leave crops rotting in California, farmers fear collapse

SACRAMENTO, California: California's multibillion-dollar farms are facing a growing crisis—not from drought or pests, but from a sudden...

Texas

SectionUS Supreme Court backs Texas efforts to shield minors online

WASHINGTON, D.C.: In a significant ruling last week, the U.S. Supreme Court upheld a Texas law requiring age verification for users...

MLS postpones match between Austin FC and LAFC

(Photo credit: Scott Wachter-Imagn Images) Major League Soccer has announced that Saturday evening's contest between Austin FC and...

Rangers activate OF Wyatt Langford, option INF Justin Foscue

(Photo credit: Raymond Carlin III-Imagn Images) The Texas Rangers activated outfielder Wyatt Langford from the 10-day IL on Saturday...

Alabama lands 5-star safety Jireh Edwards

(Photo credit: Gary Cosby/Tuscaloosa News / USA TODAY NETWORK via Imagn Images) Jireh Edwards, a five-star safety in the Class of...

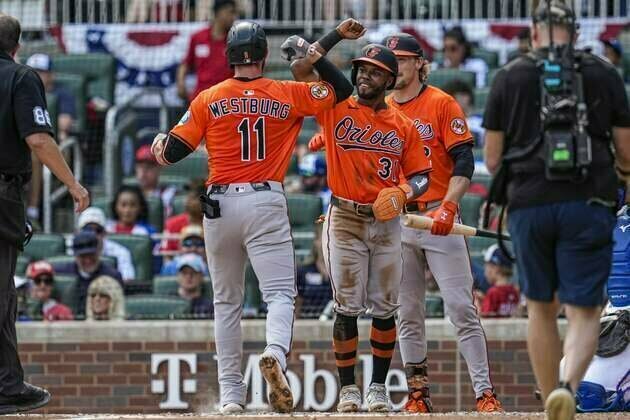

Back-to-back RBI doubles lift Orioles over Braves in 10 innings

(Photo credit: Dale Zanine-Imagn Images) Ramon Laureano and Jacob Stallings delivered run-scoring doubles in the 10th inning to help...

Daily World Briefing, July 6

Chinese FM urges China, France to uphold multilateralism, rules of free trade China and France should champion multilateralism and...