Bookkeeping Checklist for Small Businesses

Evertise

27 Oct 2022, 20:54 GMT+10

Catch-up bookkeeping services are the ideal option for a busy small business that does not have the time or resources necessary to manage taxes on its in-house. It's okay if you've been behind on your schoolwork-it happens to the best of us. Do you not have a sorted record of your business expenses or a convenient spreadsheet to track them in? It occurs regularly.

Here's a catch-up bookkeeping checklist for small businesses.

1. Assemble all relevant receipts

The first thing to do is compile each month's worth of unpaid company expenses, including relevant receipts, and bank and credit card statements. The IRS only wants receipts for purchases above $75, so don't panic if you can't produce invoices for smaller meals.

All current and former suppliers should have their invoices on file. Contact your suppliers immediately if you are missing any receipts, as this may significantly affect your tax deductions.

It is recommended that you make a digital copy of your bills and receipts as a safety measure. It's possible to use several programs to store and arrange them after they've been uploaded.

Step 2: Monitor Bills and Payments

Determine whether or not all bills have been sent and settled by reviewing your customer accounts. How these transactions are recorded depends on whether you employ a cash or accrual accounting system.

Complete any outstanding invoices, and follow up on any payments that are past due. It is possible to deduct the amount owed to you by a customer who has defaulted on their payments as a bad debt.

3. Reconcile your bank accounts.

Your bank and credit card statements are ready; it's time to sit down and reconcile everything. All the transactions on your bank statement must be matched up with their corresponding entries in your books. Find the mistakes and correct them if the sums don't add up. You should be able to reconcile the amount shown on your bank statement with what is recorded in your books.

You can use Quickbooks or other software to help you reconcile your books if you don't have a professional bookkeeper.

Step 4: Distinguish Expenses

Don't mix business with pleasure; constantly maintain a wall between the two. If you get them mixed up, you'll have a lot of extra work to do to sort them out, and you might even be held personally responsible for any business debts or damages.

Review your bank statements carefully to confirm that all of the money spent was for legitimate business needs. If you need help determining if an item is tax deductible for your business, consult the IRS's Business Expense Guide.

Set 5: Compile W-2s, W-9s, and 1099s

The final stretch is almost over. You should schedule some time to keep records and file tax forms if you had independent contractors or workers. For any payments to independent contractors totaling more than $600, a W-9 and 1099-MISC are required.

A W-2 form, detailing an employee's wage and tax information, is required if you have staff.

6. Hire a catch-up bookkeeper

If you're reading this and shaking your head because you know you don't have time to complete all of this bookkeeping, you can do what millions of business owners do every year and engage a service to help them get caught up. They're the ones who put in the extra effort and spend a lot of time doing the work. Because of their expertise, they are also able to spot potential tax savings that you had overlooked. On the other hand, they aid you in avoiding mistakes that could result in hefty fines and penalties from the IRS.

Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of Austin Globe news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to Austin Globe.

More InformationBusiness

SectionEngine defect prompts Nissan to recall over 443,000 vehicles

FRANKLIN, Tennessee: Hundreds of thousands of Nissan and Infiniti vehicles are being recalled across the United States due to a potential...

Microsoft trims jobs to manage soaring AI infrastructure costs

REDMOND, Washington: Microsoft is the latest tech giant to announce significant job cuts, as the financial strain of building next-generation...

Stocks worldwide struggle to make ground Friday with Wall Street closed

LONDON UK - U.S. stock markets were closed on Friday for Independence Day. Global Forex Markets Wrap Up Friday with Greeback Comeback...

Nvidia briefly tops Apple’s record in AI-fueled stock rally

SANTA CLARA, California: Nvidia came within a whisker of making financial history on July 3, briefly surpassing Apple's all-time market...

ICE raids leave crops rotting in California, farmers fear collapse

SACRAMENTO, California: California's multibillion-dollar farms are facing a growing crisis—not from drought or pests, but from a sudden...

Trump signals progress on India Trade, criticizes Japan stance

WASHINGTON, D.C.: President Donald Trump says the United States could soon reach a trade deal with India. He believes this deal would...

Texas

SectionUS Supreme Court backs Texas efforts to shield minors online

WASHINGTON, D.C.: In a significant ruling last week, the U.S. Supreme Court upheld a Texas law requiring age verification for users...

Texas floods raise death toll to 24

Around two dozen girls remain missing after a deadly flash flood swept through a local Christian camp Deadly flash flooding in the...

WR Kaydon Finley shuns dad's alma mater, picks Notre Dame

(Photo credit: Ronald W. Erdrich/Reporter-News / USA TODAY NETWORK) Four-star wide receiver Kaydon Finley has committed to Notre...

Former NFL LB Bryan Braman battling rare cancer

(Photo credit: Geoff Burke-Imagn Images) Former NFL linebacker Bryan Braman is 'in the fight of his life,' battling a rare and aggressive...

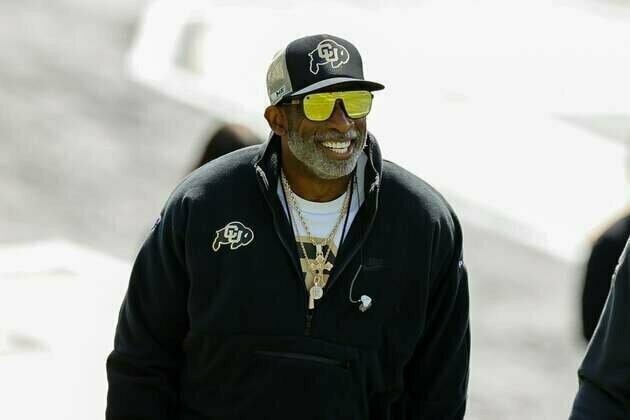

Ailing Deion Sanders expected to return to work soon

(Photo credit: Isaiah J. Downing-Imagn Images) Colorado coach Deion Sanders, who has been suffering from an undisclosed medical condition,...

Mariners' Cal Raleigh could surpass franchise icon against Pirates

(Photo credit: Stephen Brashear-Imagn Images) Dan Wilson and Ken Griffey Jr. were teammates when the latter hit a franchise-record...