When Should You Get E&O Insurance?

Evertise

12 Sep 2022, 15:54 GMT+10

Part of being human is making mistakes. Unfortunately, mistakes made in the business world could lead to a lawsuit, unhappy customers, and/or a bad reputation in the long run. According to Linkedin, humans make three to six errors per hour and on average 50 errors per day. Thankfully, professional liability insurance policies protect businesses if a major error happens in the workplace or on the job. Sometimes property damage happens, a big typo is mistaken in an advertisement, or a computer repair leads to important data being lost. Either way, professional liability insurance is sometimes more commonly referred to as errors and omission insurance (E&O) can be a lifesaver. When should you get E&O insurance though? We'll answer that question and more below.

What is E&O Insurance?

We all make mistakes and E&O insurance protects your business in the case of a huge error, omission, and/or oversight in work. Many consider it a specialized type of liability protection that comes in handy if a client decides to sue you for errors, negligent acts, major mistakes, and more that lead to financial loss. Most businesses already have business liability insurance in place that may cover bodily injury and property damage, but E&O will cover all of your bases. For example, if you offer plumbing services, and a worker's mistake causes flooding, E&O insurance will take care of any issues that arise because of this.

Who Needs E&O Insurance?

If you provide a service for a fee, then it's highly imperative for you to get E&O insurance. In certain states such as Alaska, Wyoming, and Kentucky, licensing boards require E&O insurance. Real estate agents are required by law to have professional liability insurance. If you provide advice or label yourself an expert, then it would be beneficial to get E&O insurance. Some of the most common types of businesses that benefit from E&O insurance include accountants, graphic designers, tax preparers, advertising agencies, business consultants, technology professionals, financial advising, and more. Some clients might ask if you have E&O insurance before working with you, so it would be best to get a policy ahead of time.

What Does E&O Insurance Cover?

Errors and omissions insurance covers a variety of things depending on the specific policy. Error and omissions insurance typically covers legal costs, breach of contract, negligence, false or inaccurate advice, and misrepresentation. E&O also covers copyright infringement, claims, damages, temporary staff, independent contractors, settlements, and violations of good faith. If your business experiences a loss in earnings during your time in court, certain policies will reimburse you for this.

What Doesn't E&O Insurance Cover?

E&O insurance covers several different situations, but it doesn't cover everything. E&O insurance doesn't cover bodily injury, property damage, discrimination or harassment claims from employees. It also doesn't cover illegal acts, purposeful wrongdoing, data leaks, employee illnesses, and work-related illnesses. A lot of these situations are covered by compensation insurance, business liability insurance, and cyber insurance.

When Should You Get It?

You should get professional liability insurance as soon as possible, especially if you're a small business that offers services. It's better to get ahead of the curve before you're faced with a lawsuit and/or your business takes a large financial hit due to a human error. Mistakes happen all of the time on jobs and it's beneficial to be prepared for the worst, rather than cleaning up a mess later.

E&O Insurance Costs

E&O insurance varies from company to company and the price depends on several different factors. Some of these factors include the size of the business, the number of employees, the specific industry, the business location, the types of risks you face, and the revenue of the business. According to Forbes, the median cost of E&O insurance is $65 per month. Most small business owners pay anywhere from $500 to $1000 per year for their professional liability insurance policy. If your business has filed several claims, then you'll most likely be paying a higher premium. If you work in an industry that has a large number of risks, then you'll be paying a higher amount.

Conclusion

No matter how consistent or detail-oriented your employees might be, it's inevitable that someone's going to make a mistake one day that could cost your business a significant amount of money. Even artificial intelligence and computer programs have been known to make a mistake from time to time. So, it's wise for any business that offers a service or charges a fee, to invest in an E&O policy to prevent financial loss. It's required in certain states, but is beneficial for just about any business looking to cover all of the bases, especially businesses looking for longevity. It's relatively affordable for small businesses, but doesn't cover certain expenses such as property damage or bodily injury.

Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of Austin Globe news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to Austin Globe.

More InformationBusiness

SectionEngine defect prompts Nissan to recall over 443,000 vehicles

FRANKLIN, Tennessee: Hundreds of thousands of Nissan and Infiniti vehicles are being recalled across the United States due to a potential...

Microsoft trims jobs to manage soaring AI infrastructure costs

REDMOND, Washington: Microsoft is the latest tech giant to announce significant job cuts, as the financial strain of building next-generation...

Stocks worldwide struggle to make ground Friday with Wall Street closed

LONDON UK - U.S. stock markets were closed on Friday for Independence Day. Global Forex Markets Wrap Up Friday with Greeback Comeback...

Nvidia briefly tops Apple’s record in AI-fueled stock rally

SANTA CLARA, California: Nvidia came within a whisker of making financial history on July 3, briefly surpassing Apple's all-time market...

ICE raids leave crops rotting in California, farmers fear collapse

SACRAMENTO, California: California's multibillion-dollar farms are facing a growing crisis—not from drought or pests, but from a sudden...

Trump signals progress on India Trade, criticizes Japan stance

WASHINGTON, D.C.: President Donald Trump says the United States could soon reach a trade deal with India. He believes this deal would...

Texas

SectionUS Supreme Court backs Texas efforts to shield minors online

WASHINGTON, D.C.: In a significant ruling last week, the U.S. Supreme Court upheld a Texas law requiring age verification for users...

Texas floods raise death toll to 24

Around two dozen girls remain missing after a deadly flash flood swept through a local Christian camp Deadly flash flooding in the...

WR Kaydon Finley shuns dad's alma mater, picks Notre Dame

(Photo credit: Ronald W. Erdrich/Reporter-News / USA TODAY NETWORK) Four-star wide receiver Kaydon Finley has committed to Notre...

Former NFL LB Bryan Braman battling rare cancer

(Photo credit: Geoff Burke-Imagn Images) Former NFL linebacker Bryan Braman is 'in the fight of his life,' battling a rare and aggressive...

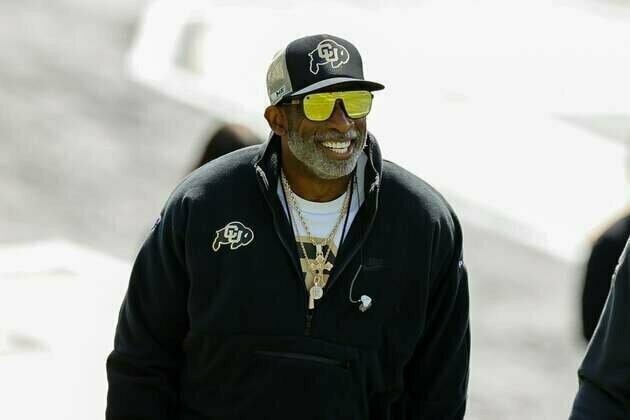

Ailing Deion Sanders expected to return to work soon

(Photo credit: Isaiah J. Downing-Imagn Images) Colorado coach Deion Sanders, who has been suffering from an undisclosed medical condition,...

Mariners' Cal Raleigh could surpass franchise icon against Pirates

(Photo credit: Stephen Brashear-Imagn Images) Dan Wilson and Ken Griffey Jr. were teammates when the latter hit a franchise-record...