Learn how you can get a high risk merchant account

Evertise

24 Aug 2021, 21:54 GMT+10

A merchant refers to any person or business that sells products or services. You can also find an e-commerce merchant who can be a person or business that operates only on the internet. Therefore, a merchant can sell products or services to the customers to make profits. Any merchant needs to care for their customers because they have the required knowledge of the services and products that they sell.

That said, merchants can be retailers or wholesalers, and they can do their businesses anywhere. Today, many merchants have realized the importance of getting high risk merchant accounts. In this article, you will learn how you can get a high risk merchant account.

Understanding a merchant account

A merchant account is simply one type of bank account that can allow you to accept debit cards and credit cards electronically. These cards are presented by customers to make payments for the services or products that they buy. Remember that merchant accounts are not the normal bank account.

If you happen to own an e-commerce business, then it's crucial to opt for cashless payments that your customers trust and provide high-security standards. Therefore, you should consider getting a merchant account that can process payments from your online customers.

There are many factors that can determine getting the right merchant account. When you start handling customers' payments, you can easily realize that there are always some hidden fees for each transaction that you need to settle.

In most cases the merchant is supposed to pay transaction fees. These fees include those from the credit card transactions, merchant account issuing bank, and payment processors. Therefore, it makes sense for you to choose a service provider with reduced costs per transaction.

Remember that there is no guarantee of having reliable support and service when you decide to choose low processing fees. To have a business bank account there are several things that you should have. These include a business license as well as an employer identification number. This employer identification number works like a social security number when it comes to settling tax obligations.

You can have a merchant account if your credit score is positive. You should also consider clearing all bankruptcy records and declare any merchant accounts that you have.

You can also find some merchant accounts that provide special features, especially for business owners that have large volumes. But these features usually come with higher fees. It's important to know your operating costs to determine if a potential merchant account meets the needs of your business.

When applying for a merchant account, you have to make an application using a form and provide all the supporting documents. You may need to provide financial statements that can be utilized to check the turnover of your company and determine the rates you make for every transaction.

On the other hand, if you have an ecommerce business, it's a good idea to do some integrations on your site and improve its SERP ranking. This is necessary to make sure that you have a secure checkout page for your customer and all payment methods are clear.

Payment gateway

A payment gateway refers to an end-to-end encrypted system that allows a merchant account to connect to an online payment network. This system connects to APIs designed to integrate with your online business to assist handle debits cards or credit cards processing.

Therefore, the payment gateway can capture all the payment details and send data to the acquiring banks to make checks for security. You need to have a good solution for fraud protection so that you can prevent penalty problems and chargebacks. This is where the payment gateway is useful.

One of the key things that an online merchant should protect apart from fast shipping and quality products is a secure transaction. This is the reason why you must have a reputable merchant account service provider. The processing fees are crucial when choosing payment gateways. Keep in mind that there can be some charges for each debit card or credit card transaction. These fees also tend to vary depending on the processor you decide to use.

The merchant account usually receives all processed payments. This is also why your business should have a merchant account so that you can receive money in real-time. You should also know that it can sometimes take up to 4 business days for the money to show in your business bank account.

Key things to take note of in payment processors

Pricing structure for transaction fees and monthly subscriptions are important things to look out for in the best merchant payment processor. Many of the solutions come with a wide range of fees when you decide to sign up like discount rate, application fees, rental fees, cross-border fees, setup fees, monthly fees, and many more.

Additional fees can increase the rate on every credit card transaction. Hence, you should look out for the available options that are on the market and compare their payment processing fees.

In most cases, many merchant service providers offer a pricing structure that includes interchange-plus, flat rate, direct interchange, and many more. A flat rate is similar to a fixed percentage and merchant service providers usually base this percentage on charges while processing payments. The pricing structure is fast to set up and easy to use. This flat rate is ideal for startup businesses and those with low sales volumes.

A direct interchange fee refers to a fee that a merchant charges for a month and it's a one-off fee. This fee is not suitable for small businesses with low volume sales.

When it comes to interchange-plus, this fee works well for a credit card transaction. Some of the major credit card issuers like Visa and MasterCard are biased towards this option. This is because this option usually has the capacity to deal with large volume payments.

As you can see, there are several things that you need to be aware of before getting a merchant account. A merchant account is important for the growth of your business, but you need to choose a reputable merchant service provider.

Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of Austin Globe news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to Austin Globe.

More InformationBusiness

SectionEngine defect prompts Nissan to recall over 443,000 vehicles

FRANKLIN, Tennessee: Hundreds of thousands of Nissan and Infiniti vehicles are being recalled across the United States due to a potential...

Microsoft trims jobs to manage soaring AI infrastructure costs

REDMOND, Washington: Microsoft is the latest tech giant to announce significant job cuts, as the financial strain of building next-generation...

Stocks worldwide struggle to make ground Friday with Wall Street closed

LONDON UK - U.S. stock markets were closed on Friday for Independence Day. Global Forex Markets Wrap Up Friday with Greeback Comeback...

Nvidia briefly tops Apple’s record in AI-fueled stock rally

SANTA CLARA, California: Nvidia came within a whisker of making financial history on July 3, briefly surpassing Apple's all-time market...

ICE raids leave crops rotting in California, farmers fear collapse

SACRAMENTO, California: California's multibillion-dollar farms are facing a growing crisis—not from drought or pests, but from a sudden...

Trump signals progress on India Trade, criticizes Japan stance

WASHINGTON, D.C.: President Donald Trump says the United States could soon reach a trade deal with India. He believes this deal would...

Texas

SectionUS Supreme Court backs Texas efforts to shield minors online

WASHINGTON, D.C.: In a significant ruling last week, the U.S. Supreme Court upheld a Texas law requiring age verification for users...

Texas floods raise death toll to 24

Around two dozen girls remain missing after a deadly flash flood swept through a local Christian camp Deadly flash flooding in the...

WR Kaydon Finley shuns dad's alma mater, picks Notre Dame

(Photo credit: Ronald W. Erdrich/Reporter-News / USA TODAY NETWORK) Four-star wide receiver Kaydon Finley has committed to Notre...

Former NFL LB Bryan Braman battling rare cancer

(Photo credit: Geoff Burke-Imagn Images) Former NFL linebacker Bryan Braman is 'in the fight of his life,' battling a rare and aggressive...

Ailing Deion Sanders expected to return to work soon

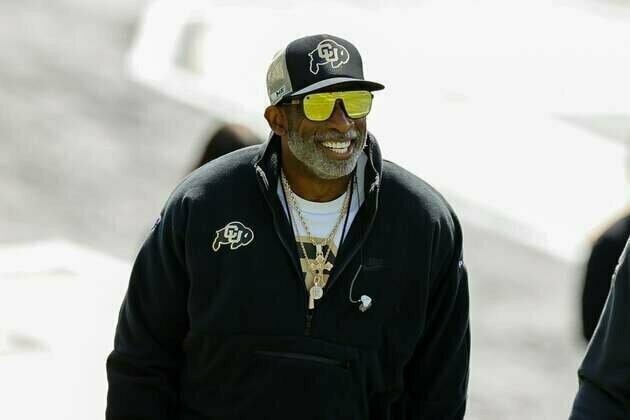

(Photo credit: Isaiah J. Downing-Imagn Images) Colorado coach Deion Sanders, who has been suffering from an undisclosed medical condition,...

Mariners' Cal Raleigh could surpass franchise icon against Pirates

(Photo credit: Stephen Brashear-Imagn Images) Dan Wilson and Ken Griffey Jr. were teammates when the latter hit a franchise-record...